The buzz around e-invoicing has grown in prominence within the business sector since the GST Council adopted the notion of e-invoicing. The GST Council approved the implementation of e-invoices at its 37th meeting in September 2019, with the primary goal of ensuring the interoperability of e-invoices across the GST ecosystem.

In October 2020, the Goods and Service Tax (GST) introduced electronic invoices for business-to-business transactions. The minimum requirement was initially set at 500 crores but was later dropped to Rs. 10 crores, which might get dropped further.

Latest update (11th May 2023)

The center has announced that e-invoicing will be mandatory for businesses with an annual turnover of over 5 crores from 1st August 2023.

What Is An E-Invoice?

An e-invoice, or electronic invoice, is a digital accounting document (Invoice/ Credit Note / Debit Note) that is exchanged between a seller and buyer and is validated by the government tax portal.

To put it simply, it’s your normal invoice/debit note/credit note authenticated by the Goods and Services Tax Network (GSTN).

See how Refrens helps you automate the entire process >

Why E-invoicing Was Implemented?

To understand why the government is shifting toward e-invoicing, we need to look at the before and after picture of how the GST system works.

Before E-Invoicing

Businesses have been using hundreds of different accounting software to generate invoices, and each software has its own unique format. This makes it hard for the GST system to read all this data even though the information in the invoice remains the same across formats.

Due to the lack of a standard format,

- It was really hard for the central system to read all these documents.

- Businesses had to re-submit the same documents manually in different formats to different entities like GST Portal and e-Way Bill, which was inefficient.

- A lot of discrepancies arose during manual data entry and reconciliation.

- There was no interoperability between different systems.

Also, as businesses had considerable time between generating an invoice and filing it to GSTN, they could potentially make changes to the invoices and engage in fraudulent activities.

After E-Invoicing

E-invoicing ensures that a common, standard format is followed by all businesses while reporting invoices to the GST portal. Not only does the standard format make compliance easier, but because it’s followed across industries, interoperability between GST ecosystems is ensured.

Also, once an IRN is generated and the invoice has been authenticated, all the invoice-related information is then transferred to both the GST portal and e-way bill portal in real time. This eliminates the need for entering the data manually for Part-A of the e-way bills and during return filing as an invoice, data will be pre-populated in GSTR-1 of the supplier and GSTR-2A of the recipient.

It will also help in curbing tax evasion. With an e-invoice, the chances of editing invoices will be low because before any transaction is done, the invoice gets generated. Another thing is that it ensures the authorities have information about all the transactions in real-time. The system can identify fake invoices by matching the input tax credit to the output tax on the GSTN portal, preventing tax crimes.

Recommended read: Top 5 E-Invoicing Software

Eligibility & Exemptions

Currently, businesses with an annual turnover of more than 10 cr have to comply with e-invoicing guidelines. This limit might further get reduced in the future.

| Annual Turnover | Date of mandatory implementation of e-invoice |

| Exceeding 500 crore | 1st October 2020 |

| Exceeding 100 crore | 1st January 2021 |

| Exceeding 50 crore | 1st April 2021 |

| Exceeding 20 crore | 1st April 2022 |

| Exceeding 10 crore | 1st October 2022 |

| Exceeding 5 crore | 1st August 2023 |

There are some exemptions that the government has stated. These business entities will not be required to generate e-invoices and can operate like before.

- Insurance Companies

- Banking Company or a Financial Institution, including a Non-Banking Financial Company (NBFC)

- Goods Transport Agency (GTA) transporting goods by road in a goods carriage

- Transport service provider, providing passenger transportation service

- A registered person providing services of – admission to an exhibition of cinematograph films on multiple screens

- Special Economic Zone (SEZ) units

- Free Trade & Warehousing Zones (FTWZ)

How To Generate E-Invoices?

1. Understanding The Technicalities

There are two parts to generating an e-invoice:

- Preparing the Invoice itself, and

- It’s Electronic Authentication

Firstly, e-invoicing doesn’t mean generating an Invoice. It just means that you have to submit an already generated invoice on a common e-invoice portal by following a standard format notified by GSTN.

So, what happens after you submit an invoice on the e-invoice portal? How does it get authenticated by the portal?

The digital invoice generated by accounting software gets transmitted on the IRP (Invoice Registration Portal), the e-invoicing portal.

Then the portal examines your invoice and tries to identify if the submitted information is valid or not. Once the invoice gets validated, the portal will create an IRN (an Invoice Reference Number that is unique to each invoice), generate a QR code using a QR code generator, and send this data back to your accounting software. The seller needs to print the QR code and IRN number on the invoice before issuing it to the buyer.

So basically, the government is digitally signing the invoice with an IRN and a QR code to convey that your invoice is authenticated.

2. Creating An E-Invoice

An e-invoice is generated by the official government portal, and the steps to be followed are mentioned as follows –

- Create a GST invoice that is compliant with the government guidelines, and consists of the mandatory fields (discussed below in the article). Software like Refrens can help you automate the entire process of creating e-invoices.

- Convert the GST invoice into JSON form, this is important because the software accepts data only in the JSON format, hence it’s advisable to check with your accounting software if they provide data in JSON format. If you are using Refrens, you don’t have to worry about this step as Refrens handles it for you.

- One can either manually upload the invoice on the portal and wait for the system to authenticate the invoice, and then send the updated invoice the IRN, and the QR code, or use an E-invoicing software like Refrens to automate the entire process.

- The final invoice with the IRN and the QR code will be system generated and sent to the business which can be further sent to the recipient.

See how easy it is to create E-Invoices on Refrens >

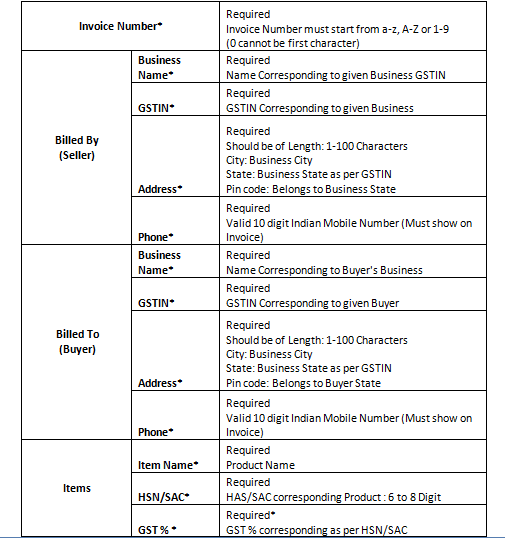

3. Mandatory Fields For Generating E-Invoices

To ensure that you can generate e-invoices without any errors, your invoice needs to have the following fields:

Also read: Best Billing Software For Retail Shops & Distributors>

Is It Possible To Partially Or Completely Cancel An E-Invoice?

An e-invoice cannot be partially canceled, but it has to be completely canceled, and It must be submitted to the IRN within 24 hours of cancellation. Any subsequent attempts to cancel must be done manually on the GST portal before the returns are filed, as this cannot be done on the IRN.

How to cancel an e-invoice?

Cancel single Invoice

- Login to the e-Invoice portal and select ‘Cancel’ in the sidebar.

- Enter either the Acknowledgement number or the IRN and click on Go.

- Choose the e-invoice to be canceled, and enter Cancellation Reason and click on Submit.

Cancel bulk e-Invoices

- Visit the e-Invoice portal. Go to Help > Tools > Bulk Generation Tools.

- Download the e-Invoice Cancel by IRN > JSON Preparation offline utility.

- Enter the IRN, Reason for Cancellation, and Cancel Remarks, and click on Validate

- Click on Prepare JSON once the file is validated.

Login to the e-Invoice portal and click on e-Invoice and on Bulk IRN Cancel and upload the JSON file.

How To Revise An E-invoice?

So first you need to generate a fresh invoice, raise a credit note for the canceled invoice, and then upload the amended invoice to the portal, or your e-invoicing software.

If a business wants to cancel an already reported e-invoice, you can do so by uploading the IRN, or any of the following details after logging into your portal –

– GSTIN

– Type of document

– Document number

– Document date

Once an invoice is canceled, the same invoice number can not be used again to generate another invoice.

Is E-Invoicing mandatory?

Yes, as of August 2023, generating e-invoices is mandatory for businesses with an annual turnover of more than 5Cr rupees.

What Happens If You Don’t Generate An E-Invoice?

Non-generation of an e-invoice is a crime that carries a penalty. It is punishable by a fine of up to Rs.10,000 per invoice. In addition, erroneous billing might result in Rs.25,000 penalty for each invoice.

If a taxpayer misses the deadline for generating an e-invoice, he or she will face penalties.

- Your GST returns will not be automatically filled out.

- Your consumers will be unable to claim ITC that has been validated.

- Customers may refuse to accept invoices that do not follow e-invoicing guidelines.

How To Enable E-invoice In GST?

There is an option in the https://einvoice1.gst.gov.in portal under the registration menu as ‘e-Invoice Enablement’.

You would be required to enter your GSTIN and validate it with the OTP sent to you via the registered email ID and phone number. After that, you would be required to enter your business turnover, and other details, and hit submit. After the acceptance, you would be eligible to generate e-invoices.

What Is JSON In E-Invoice?

A JSON(Javascript Object Notation) is a file format that is readable by a computer program, also human legible, and often used as a standard format to send data across programs and software.

The JSON file is used by the GSTN for GST return preparation and filing. The Government has provided an offline GST return preparation tool that generates JSON files that can be filed on the GST Portal, otherwise one can also use multiple free tools on the internet to generate JSON.

If you are using software like Refrens, you don’t have to worry about this as it is handled by Refrens only.

How To Generate Multiple E-invoices In Bulk?

Many businesses operate on a big scale and may have 100s or 1000s of invoices to be processed every day, and therefore the government portal has provided methods to facilitate the generation of multiple invoices.

The taxpayer needs to have the EINV bulk converter installed in his system. This is an Excel-based offline utility that helps convert multiple invoices entered in the Excel sheet into a single JSON file for bulk upload. In order to download this tool, visit the trial e-invoice portal. Go to Help > Tools > Bulk Generation Tools. Select the tool which is most appropriate.

Again, if you are using Refrens, you don’t have to worry about this. you can just select invoices and with a couple of clicks you can generate e-invoices in bulk.

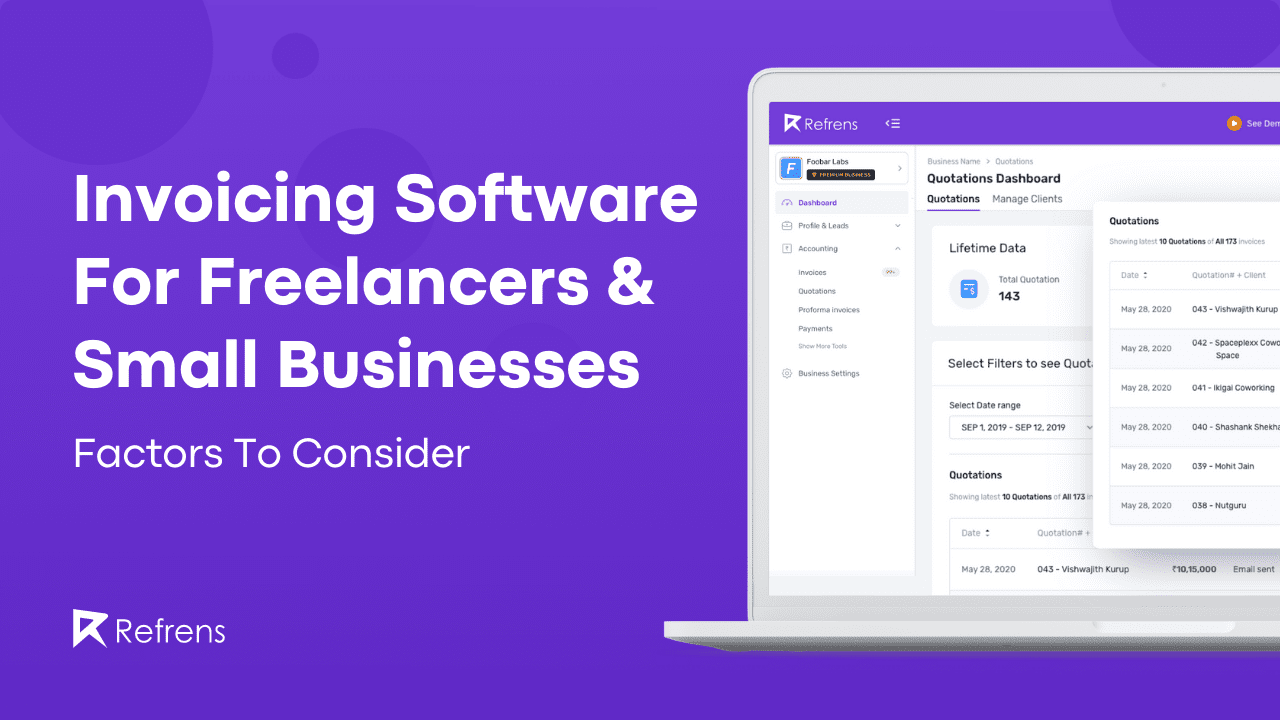

Why Use Refrens For Generating E-Invoices?

E-invoicing is going to be a critical part of your day-to-day business. So, it’s important that the software you choose is easy to use and reliable, as choosing the wrong software can cause you a lot of headaches in your daily operations, and no one wants that.

Refrens has been a trusted partner to over 150K+ businesses in over 178 countries for their invoicing needs, and there’s a reason why so many businesses rely on us to run their business efficiently.

For small enterprises and freelancers, Refrens provides simple, easy-to-understand, and rapid billing software. GST invoices from Refrens are specifically suited for Indian markets. Our online bill generator takes care of everything for you, including creating and managing invoices, recurring bills, and collecting payments, among other things.

Simply put in the relevant information to generate invoices in a matter of seconds. With an online GST invoice generator, you can create professional GST invoices in a matter of seconds, even if you have no prior knowledge of GST. Create a personal brand by including a personal logo, digital signature, terms, and attachments such as files and photographs, among other things. The user-friendly layout makes it easy to keep track of all your invoices in one spot.

Not only does Refrens’ online GST bill generator enable GST invoicing, but it also supports over 200 countries and different currencies, including the rarest of the rare. If your company has international clients, you can change the currency on e-invoices with a single click. Refrens makes it simple to create GST e-invoices and generate your e-invoice IRN in seconds.

With Refrens GST bill generator, you may receive online payments faster. You can accept online payments in a variety of ways, including UPI, Net Banking, Debit/Credit cards, and more. Refrens is currently one of India’s most trusted platforms for receiving overseas payments. All payouts are completed within two business days.

The online bill generator allows you to email invoices to clients, download bills as PDFs, and print invoices. Not only that, but you can also share the link or use WhatsApp to do so (after copying the link).

Start generating your e-invoice now!

E-Invoicing FAQs

Can We Modify An E-Invoice?

No, you cannot modify an e-invoice because that is generated by the system, and if there are any cancellations that are made to the invoice, it should be informed on the IRN portal within 24 hours, and failing to do is a compliance issue.

What Is GSP In GST?

GSP stands for GST Suvidha Provider. A GSP enables a GST taxpayer to comply with all the procedural provisions of the GST law through its web platform.

Do We Need E-Invoices For B2C Businesses?

No. Currently, the e-invoicing system is only for B2B businesses where the consignor and the consignee are GST-registered and eligible for e-invoices.

Can an e-invoice be generated after the invoice date?

Yes, e-invoices can be created within 7 days from the invoice date.

What Do Consignor & Consignee Mean In An E-Invoice?

A consignor is an entity that provides the service, or the product. For example, if you buy food from a restaurant, where the restaurant is the consignor, and the recipient(you) is the consignee.

Is e-invoice required for the Export of Services?

Yes, if you are eligible for e-Invoicing, all the invoices of B2B and Exports need to be registered.

Is there any time limit for delivery of goods or generation of e-waybill in e-Invoice?

No, there is no time limit for the delivery of goods or generation of an e-waybill for the e-invoice.

Do you need to upload RCM Invoices also?

Yes, if you are eligible for e-Invoicing, all the invoices including RCM invoices issued by the Supplier need to be registered.

When the billing address is in one state and the shipping address is in another state, which GST will apply – IGST or CGST/SGST?

The type of GST (whether IGST or CGST/SGST) is determined by POS (Place of Supply). If the Supplier state is the same as POS, then it is CGST/SGST else IGST for B2B transactions.

How to generate E-invoice for Services?

The e-invoice for services are generated like any other invoice, by mentioning the related SAC code and the total price in unit rate and the quantity may be mentioned as one.

In how many days can we generate an e-invoice after preparing the manual invoice and e-Waybill?

Ideally, the e-invoice must be generated after preparing the manual invoice and before issuing it to the customer. The system presently allows you to register invoices for the previous periods too.

How to include freight charges in the E-invoice?

Freight charges may be entered as line items in case there is a GST component or else they may be entered under ‘Other charges’.

Can the shipping bill number and date be entered in the e-invoice?

Yes, they can be entered. Please refer to the schema of the invoice for more details.

Is there any time limit to prepare a credit note against E-invoice?

No, there is no time limit to prepare the credit notes or debit notes against the e-Invoice.

Is the shipping bill number mandatory while preparing an e-invoice?

No, the shipping bill number or date is not mandatory for preparing an e-invoice.

I have crossed the notified Turnover in the current year, do I need to upload my invoices?

No, e-invoice is applicable only if the notified turnover is crossed in the previous years.

Instead of sending the portal-generated invoice can we send the regular format to the customer?

The invoice sent to the customer must contain the IRN number and the QR Code. Along with this, you may send the regular invoice.

How do I upload invoices, in case I do not have an ERP system?

The e-invoice portal helps the suppliers register the invoices without the necessity of the ERP system. This is a browser-based and user-friendly portal by which e-invoices can be generated. The application may also be downloaded onto the mobile.

Is e-Invoicing applicable if my customers are of SEZ type?

Yes, it’s applicable. If the customer is of type SEZ, then an e-invoice may be generated using transaction type as SEZWP / SEZWOP by the Supplier.

In how many days can we generate an e-invoice after making the invoice and e-waybill?

Ideally, an e-invoice must be generated after making the manual invoice and before issuing the invoice to the customer. Presently, the system allows for the invoices to be registered for the previous period also.

If we miss uploading the invoices, then what is the solution?

Presently, the system allows for the invoices to be registered for the previous period. So, if you have missed uploading, then you may still generate an e-invoice for the previous period’s invoices.

Do we need to upload the Digital signature on the E- Invoice portal?

No, the supplier cannot upload the digitally signed invoice to the portal. The e-invoice system will digitally sign the e-invoice details uploaded to the portal and return the signed invoice and QR code to the Supplier.

Can we upload export invoice details with foreign currency?

All invoices to be registered on the portal should contain the values in INR, however, there are some optional fields in the schema in which the foreign currency may be included. Please refer to the schema

Where do I print the QR Code, IRN, and Acknowledgment number on the e-invoice?

There is no specific place for printing the QR Code, IRN, and Acknowledgement number on the invoice. However, they should be visible; in the case of a QR code, it should be possible to scan it.

I’m unable to enter the slash ‘/’ in the document number, what should I do?

Document numbers in e-Invoice should not start with 0, /, and -. You should pass the document number without such characters.

Whether manual invoice with USD/EURO Currency and an E-Invoice with INR be used? Can we upload export invoice details with foreign currency?

All invoices to be registered on the portal should contain the values in INR, however, there are some optional fields in the schema in which the foreign currency may be included. Please refer to the schema.